Becoming a Member is Easy!

1 - Eligibility

Becoming a member of FCCU is easy. We extend to you our warmest welcome and invitation to join our Community.

2 - Provide Your Info

3 - Open An Account

Open your account with an just a $5 initial deposit and you're an FCCU member.

Next Steps

Once you've opened your new FCCU account, there are a few next steps that might be helpful to consider.

Be sure to notify your employer that you want your paycheck automatically deposited into your new FCCU account. Provide them with the Direct Deposit Authorization Form, which will include your new deposit account number.

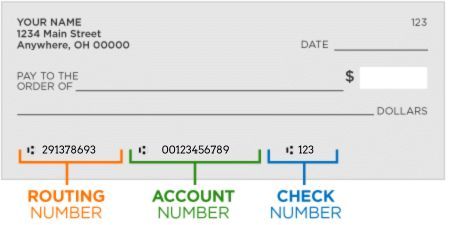

As with any new account, there can be a lot of information to remember. Here's a quick guide so you can keep everything straight.

Checking account number- This number is specific to your new checking account and it differs from your member number.

- It can be found at the bottom of your new checks (see the graphic below).

- You can also find this information within online banking (click on checking title, then the 'Account Details' drop down. Your checking account number is MICR or ACH number).

Member number- Your new member number is yours to keep forever. It identifies you as a member of FCCU. If you forget it, reference your new account documents or contact your local branch.

Routing number- Financial institutions use routing numbers to process electronic payments. FCCU's 11-digit routing number is #291378693. It’s always available on our website in the bottom footer or in the lower left-hand corner of your new checks.

Automatic transfers and online Bill Pay can be used for a variety of payments. Be sure to keep track of the items you'll transfer to your new account.

- Do you have a loan payment set up as an automatic transfer?

- Is your Netflix account charged to your old debit card?

- Is your utility or internet bill paid using online bill pay?

These are all examples of transfers you may need to make. Don’t forget to review your finances and make a complete list.

Experience the Credit Union Difference.

JOIN TODAY

Membership is a Big Deal

Did you know each year Credit Union members save $162 per household in North Dakota and $342 per household in Minnesota? Being a credit union member has its perks!***

*Insured by NCUA. **ATM fee refund options available on all FCCU checking accounts. Qualifications apply. Process varies based on account. See us for details. ***Source: Datatrac, NCUA, and America's Credit Unions. Assumes 2.1 credit union members per household.