FCCU is the proud financial partner of UND athletics!

Get your UND experience, only at FCCU!

Enjoy these benefits with your UND Visa:

- Choice of cash back or reward points

- No annual fee & low balance transfer fees

- Buy Now, Pay Later options

- UND digital wallet with Samsung, Google or Apple Pay

- Automatically receive fraud notifications by text, email & phone

- For added fraud protection and card management, access within online banking or download FCCU Cards App

- Turn your card on & off

- Set travel notices

- Report lost or stolen cards and log disputes

- 24-hour hotline available at 866-820-3866

Show Your School Spirit with a Fighting Hawks Credit Card!

Enjoy our UND Debit Card with an FCCU checking account. There are three great reward options to choose from:

- Earn High Interest: Open Kasasa Cash

- Earn Cash Back: Open Kasasa Cash Back

- Earn Points for Prizes: Open Reward Checking

Note: UND debit cards must be picked up in person at any of the following locations: Grand Forks 32nd, Crookston, Jamestown Main, Valley City, Mandan, Bismarck, Wahpeton, Fargo 45th, Fargo 52nd and Devils Lake.

Debit card benefits:

- No monthly or annual fee

- Contactless cards that are easy & secure

- Just look for this symbol at checkout and tap your card

- Just look for this symbol at checkout and tap your card

- 24-Hour ATM access

- No ATM transaction fees at FCCU's ATM machines or for qualified Kasasa® checking members

- Thousands of surcharge-free ATM locations through the NYCE, CO-OP, and Money Pass networks

- Automatically receive fraud notifications by text, email and phone

- For added fraud protection and card management, download FCCU Cards App

Show your Hawk pride with your option of two specialized UND check blanks. Only available to our UND members. Be sure to ask for these at your account opening!

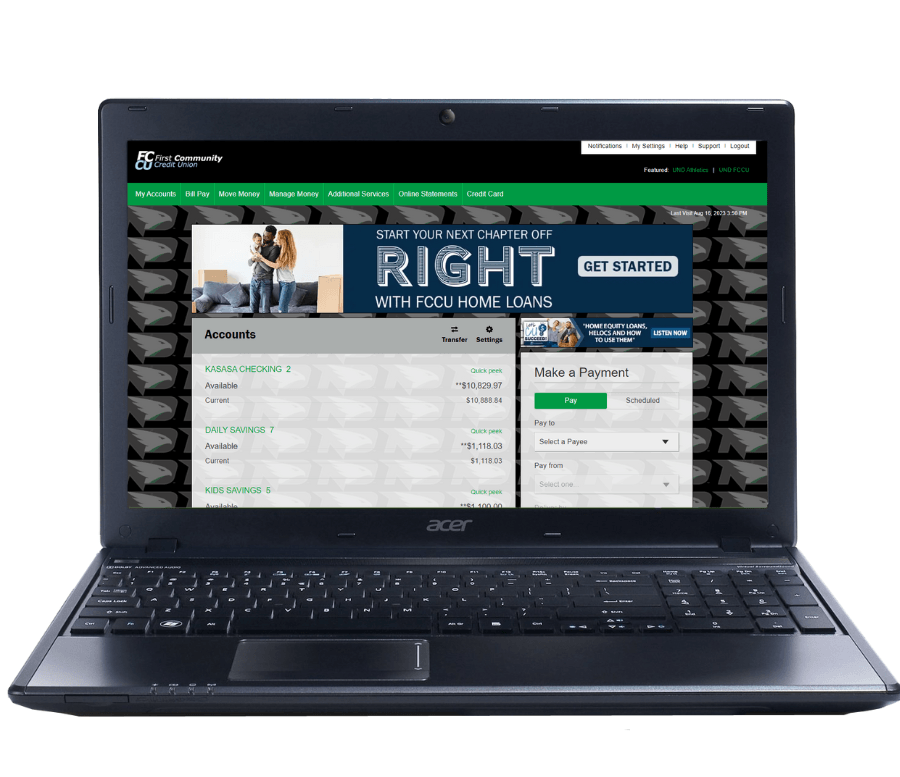

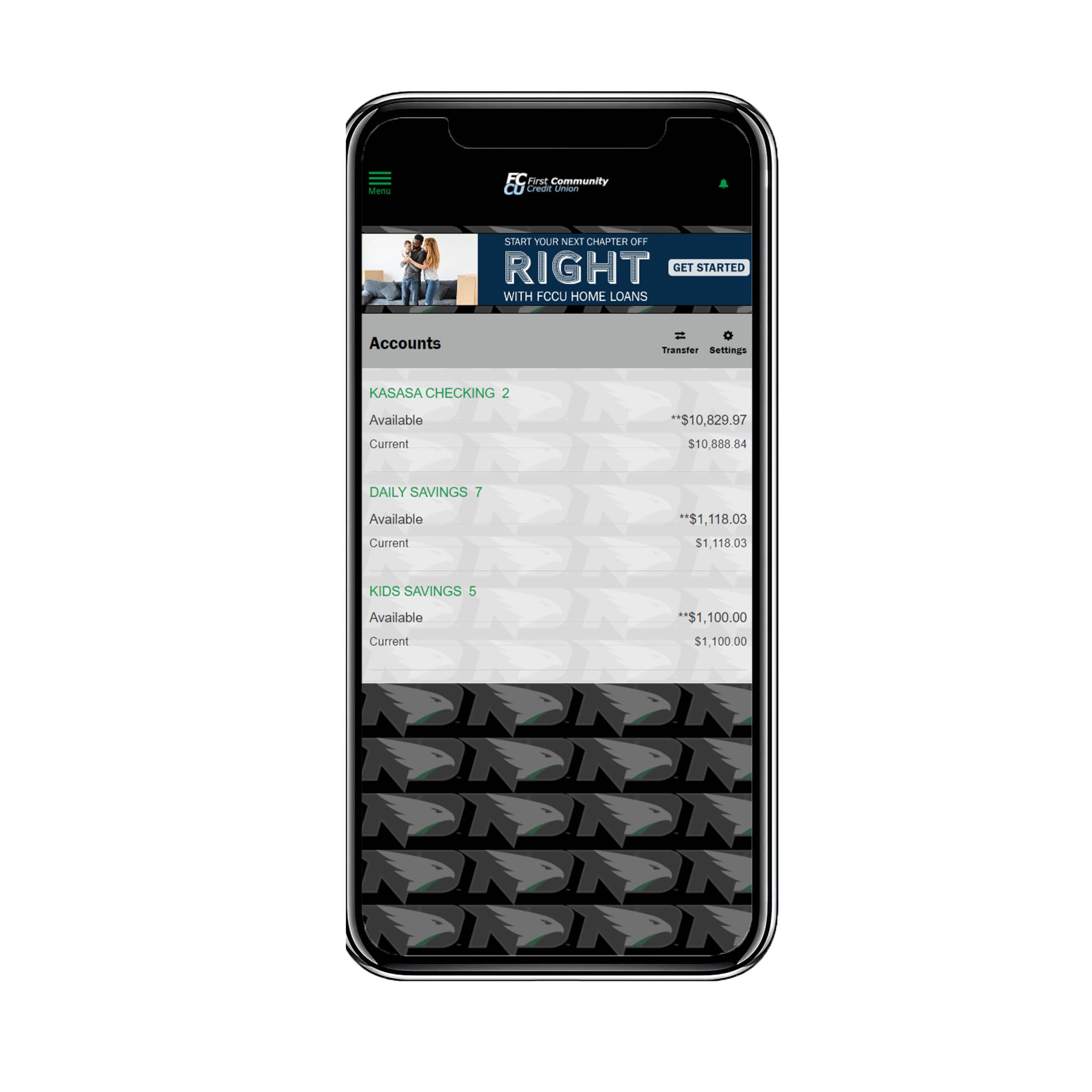

We provide a customized online experience for our valued UND members. Cheer on the UND Fighting Hawks with your online and mobile banking when you join FCCU.

Let's Go Hawks!

First Community Credit Union is the largest credit union in North Dakota, with 26 branches throughout North Dakota & western Minnesota. FCCU first laid its foundation in Jamestown, with just 40 members and now we've grown to serve more than 46,000 members.

Just like you’re a member of a community and even a family, you’re a member of a credit union and we know just how special that is.

National recognition includes the top credit union in North Dakota by Forbes, the top 50 business lending credit union and fourth largest ag lending credit union by the NCUA. Regionally, FCCU was selected as the top 50 Best Places to Work by Prairie Business magazine.

The Credit Union Difference

Use this calculator to determine your projected earnings from our Kasasa Cash account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly dividends earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total dividends earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Kasasa Cash*

| Balance | Rate | APY |

|---|---|---|

| 0 - $25,000 | 2.47% | 2.50% |

| $25,000+ | 0.15% | 2.50% to 0.62% |

| All balances if qualifications not met | 0.02% | 0.02% |

Qualifications to Earn Rewards

Enrollments must be in place and all of the following transactions and activities must post and settle to your Kasasa Cash® account during each Monthly Qualification Cycle:

- At least 12 debit card purchases

- Be enrolled in and agree to receive eStatements

- Be enrolled in and log into online banking

If you don’t qualify this monthly qualification cycle, your account is still free. Plus, you’ll still earn the base interest rate for your account. Then, next month, you can get right back to earning your full rewards.

Kasasa Saver*

| Balance | Rate | APY |

|---|---|---|

| 0 - $25,000 | 0.25% | 0.25% |

| $25,000+ | 0.15% | 0.25% to 0.17% |

| All balances if qualifications not met | 0.02% | 0.02% |

Qualifications to Earn Rewards

Qualifying for your Kasasa Cash or Kasasa Cash Back® rewards automatically qualifies you for the highest Kasasa Saver rate, too. Enrollments must be in place and all of the following transactions and activities must post and settle to your Kasasa Cash or Kasasa Cash Back account during each Monthly Qualification Cycle:

- At least 12 debit card purchases

- Be enrolled in and agree to receive eStatements

- Be enrolled in and log into online banking

If you don’t qualify this monthly cycle, your account is still free and you’ll still earn the base interest rate. Plus, you’ll get right back to earning your rewards the very next month.

APY = Annual Percentage Yield. Rates and APYs accurate as of 1/1/2021. Rates and rewards are variable and may change after account is opened. Fees may reduce earnings.